Testosterone therapy, often referred to as testosterone replacement therapy (TRT), has become a vital treatment for men experiencing symptoms of low testosterone. Whether it’s low energy, reduced sex drive, or other signs of testosterone deficiency, TRT can help restore hormone levels and improve overall quality of life. However, one of the biggest questions for those considering this treatment is: how does insurance come into play?

Is TRT Covered by Insurance?

One of the first questions many men ask is, “Is TRT covered by insurance?” The answer is not always straightforward. Coverage for testosterone therapy can vary widely depending on your health insurance plan, the specifics of your health conditions, and even the type of TRT you receive, such as testosterone injections or gels.

In many cases, health insurance will cover TRT if it’s deemed medically necessary. This usually means you’ll need to undergo a blood test to confirm low testosterone levels and present symptoms of testosterone deficiency. Your doctor may also consider factors like your red blood cell count and overall health when prescribing testosterone. However, it’s crucial to check with your insurance provider to understand what your specific plan covers.

Key Points to Consider:

- Insurance Coverage: TRT is often covered if medically necessary, but coverage details depend on your insurance plan.

- Blood Tests: Required to confirm low testosterone and justify treatment.

How Much Is TRT With Insurance?

If your insurance covers TRT, the out-of-pocket cost can still vary. Factors such as co-pays, deductibles, and whether you’re receiving testosterone injections or another form of treatment will all play a role. On average, with insurance, the cost of TRT might range from $30 to $100 per month, depending on your coverage and the treatment plan prescribed.

It’s also important to find TRT clinics that accept insurance to ensure you’re getting the most out of your coverage. Some clinics might offer lab testing and other necessary services as part of their treatment plans, which could be included in your insurance coverage.

Key Points to Consider:

- Cost With Insurance: Typically ranges from $30 to $100 per month, depending on the plan and treatment.

- TRT Clinics: Ensure the clinic accepts your insurance for optimal coverage.

How Much Is TRT Without Insurance?

If your insurance doesn’t cover TRT, or if you’re considering paying out-of-pocket, costs can add up quickly. Without insurance, the price for testosterone therapy can range from $150 to $500 per month. This includes the cost of the testosterone itself, lab testing, and ongoing medical supervision to monitor your hormone levels and red blood cell count.

Some clinics offer payment plans or discounts for cash payments, so it’s worth asking about your options if you’re concerned about the cost. However, remember that skipping necessary blood tests and monitoring to save money can lead to potential side effects or health risks.

Key Points to Consider:

- Cost Without Insurance: Can range from $150 to $500 per month, including all related services.

- Payment Plans: Some clinics may offer discounts or payment options if you’re paying out-of-pocket.

Does Insurance Cover TRT for All Health Conditions?

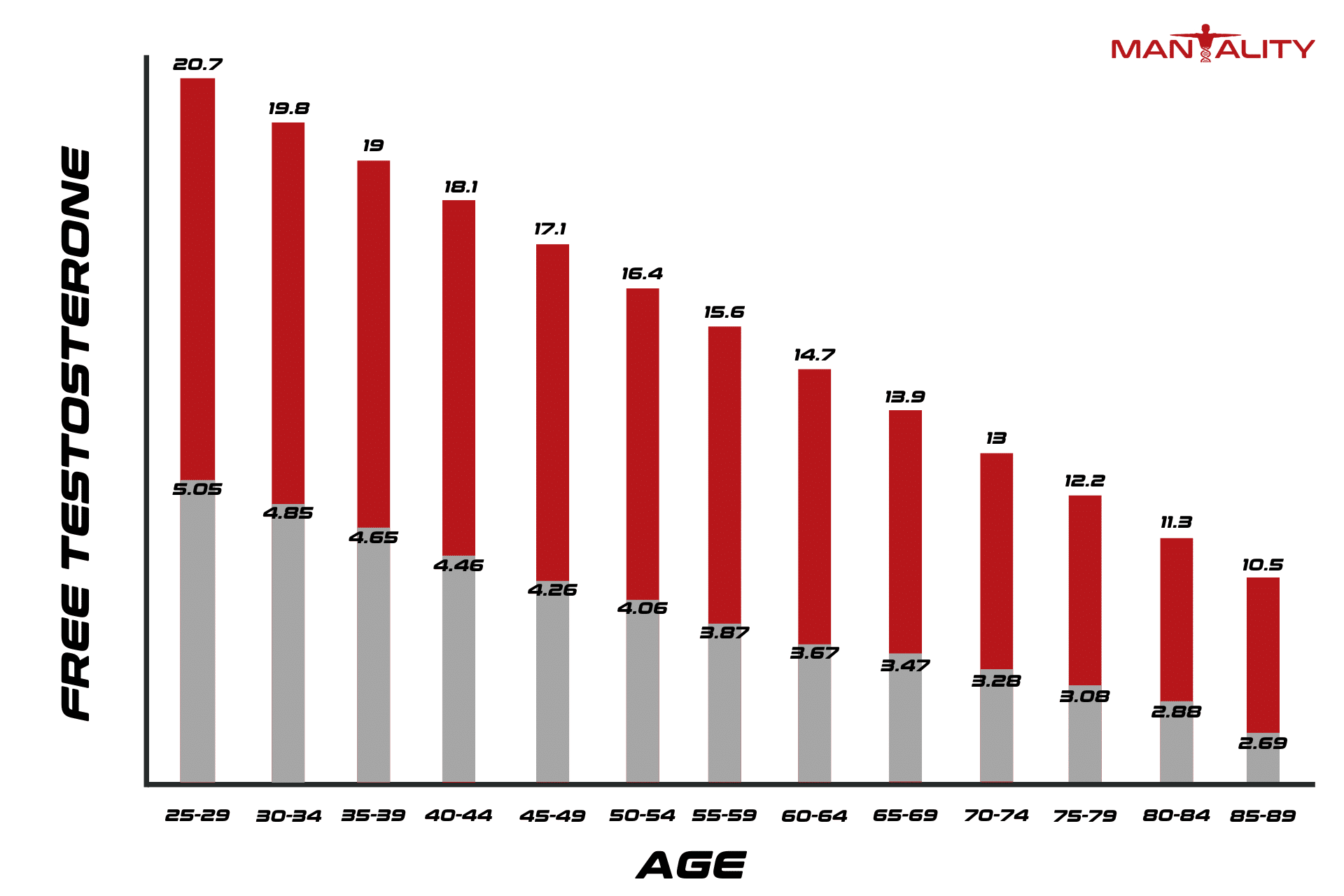

Not all health conditions are treated equally when it comes to insurance coverage for TRT. For instance, insurance is more likely to cover TRT for men with clinically low testosterone levels due to aging or medical conditions like hypogonadism. However, for those seeking TRT to boost athletic performance or for non-medical reasons, insurance coverage is generally not provided.

Your insurance plan may also require proof that other treatment options have been tried and failed before approving TRT. This could mean trying lifestyle changes, medications, or other therapies first. It’s important to work with your healthcare provider to document these efforts as part of your treatment plan.

Key Points to Consider:

- Eligibility for Coverage: More likely for medical conditions like hypogonadism; less likely for non-medical reasons.

- Proof of Necessity: Insurance may require documentation of other treatments tried.

Navigating Side Effects and Monitoring

Another important aspect of TRT is the need for regular monitoring. Testosterone therapy can have side effects, such as an increase in red blood cell count, which could lead to health issues like blood clots. Regular blood tests are crucial to ensure your levels of testosterone are within a safe range and to monitor for any potential side effects.

Insurance typically covers these lab tests as part of your overall TRT treatment plan, especially if they are necessary to adjust your dosage or treatment approach. Keeping your hormone levels in check is essential for avoiding complications and ensuring the therapy is both safe and effective.

Key Points to Consider:

- Monitoring: Regular blood tests are essential for safety and are often covered by insurance.

- Side Effects: Monitoring helps manage side effects like increased red blood cells.

The Bottom Line: Getting the Most Out of Your Insurance

Navigating the insurance landscape for testosterone therapy can be challenging, but with the right information, you can make informed decisions about your treatment. Start by checking if your health insurance covers TRT and what specific requirements they have. Look for TRT clinics that accept insurance and offer comprehensive treatment plans, including lab testing and ongoing monitoring.

Whether you’re asking, “How much is TRT with insurance?” or “How much is TRT without insurance?” understanding your options can help you find a treatment plan that fits your needs and budget. With the right approach, you can manage your testosterone levels effectively and improve your overall quality of life.